A Deeper Look Into Global Growth Trends

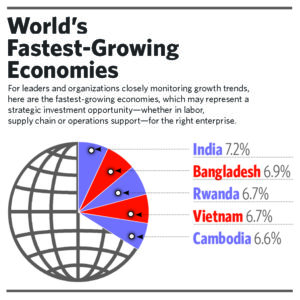

Growth may be harder for international leaders to catalyze in coming years, amid rising inflation, increasing deglobalization and heightening geopolitical volatility. But while nations clearly face fiscal headwinds, the world’s total annual GDP is poised to top $100 trillion for the first time ever this year, per economic consultancy CEBR—a figure that is anticipated to double by 2035. Even as it cut global growth forecasts for 2022, the International Monetary Fund (IMF) expects the Asia-Pacific (APAC) region to rebound from the pandemic and outperform other geographic regions over the next decade. Likewise, Lazard Asset Management sees emerging markets such as Latin America and India as well positioned for growth.

Current surges in economic growth reflect how well many of the globe’s biggest economies have adapted to and bounced back from COVID-19, Fortune magazine suggests. At the same time though, CEBR reports that inflation (particularly in nations such as the U.S.) may be propping up overall GDP numbers more than actual economic gains. Noting this, China is expected to surpass the U.S. as the planet’s biggest economy by 2030, followed by Germany, Japan, the U.K. and France. By decade’s end, APAC nations such as Indonesia, Vietnam, South Korea, Thailand and Australia will also rank among the world’s top 10 economies by GDP, the Lowy Institute reports.

While Russia’s invasion of Ukraine has dragged on global growth trends and forecasts, the IMF notes that economies that have been fast to recover from COVID-19 are better poised to withstand potential aftershocks. However, it reminds us that those still being impacted by pandemic-induced pullbacks may be hit even harder in the wake of the conflict. Recession fears also continue to grow around the world, the IMF says, as central banks’ rising interest rates may present ongoing turmoil for many nations. Nearly 60% of low-income countries are in debt distress, or near to it, double the number the IMF was tracking in 2015, Bloomberg reports.

On the bright side, according to the World Bank, over the next couple of years the global economy is predicted to grow at its fastest rate since 2017. However, it too forecasts that developing areas of the world will be those that appear to be standouts in terms of future economic growth rates, with these nations’ economies currently expanding at nearly twice global averages.

Speaking of territories to watch: Back in 2005, Goldman Sachs coined the term “Next Eleven” (or N-11) to describe 11 countries that—despite their smaller size—hold BRIC-level potential to rival G7 nations. As The Balance points out, these nations (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea and Vietnam) have all exhibited generally stable and rising economic growth. International opportunities for investment in these geographies are also growing, though political risk is also a concern in territories such as Iran and Pakistan.

Of course, developing territories also tend to be more susceptible to inflationary pressures and rising food and energy prices. Lazard Asset Management suggests that rising costs for consumer goods may weigh heavily on their populations. Countries such as Hungary, Argentina and Serbia also are moving to limit exports due to geopolitical challenges, which may have a lasting impact.

Of course, developing territories also tend to be more susceptible to inflationary pressures and rising food and energy prices. Lazard Asset Management suggests that rising costs for consumer goods may weigh heavily on their populations. Countries such as Hungary, Argentina and Serbia also are moving to limit exports due to geopolitical challenges, which may have a lasting impact.

Bearing in mind the international market’s ever more volatile economic backdrop and the global economy’s current interconnectedness, caution is advised. In today’s environment of constant change, investment strategies are best made with backup plans in mind. And despite territories’ growing shift toward fiscal independence, international trading partners’ continuing dependence on one another means that economic events have the potential to snowball.

This article appeared in the Fall 2022 issue of Insigniam Quarterly with the headline “Emerging Trends in Global Growth.”

To begin receiving IQ, click here.