Consumer Lending: Your Next Loan Officer Will Be a Bot

Despite ongoing business disruptions stemming from the pandemic, global investment in artificial intelligence technology grew to $68 billion in 2020, a whopping 40% year-over-year increase, according to Stanford University’s 2021 AI Index Report. One area seeing the rise of artificial intelligence—and the growing role that it’s playing in helping a new wave of startups disrupt the status quo—is the realm of consumer lending.

Traditionally, consumer lenders have calculated factors such as credit score, income and debt ratio when weighing potential applicants. Tomorrow’s lenders are now leveraging AI technology to upend traditional consumer lending norms.

Case in point: One of the newest consumer lending entrants—the appropriately named Upstart—is an AI-driven platform that uses nontraditional variables such as work experience, educational history and potentially even social media interactions to rate prospective borrowers.

By applying the power of data science and machine learning to analyze hundreds of nontraditional data points, companies that leverage AI are increasingly offloading time-consuming tasks to automated processes, which in turn utilize data to unlock better decision-making.

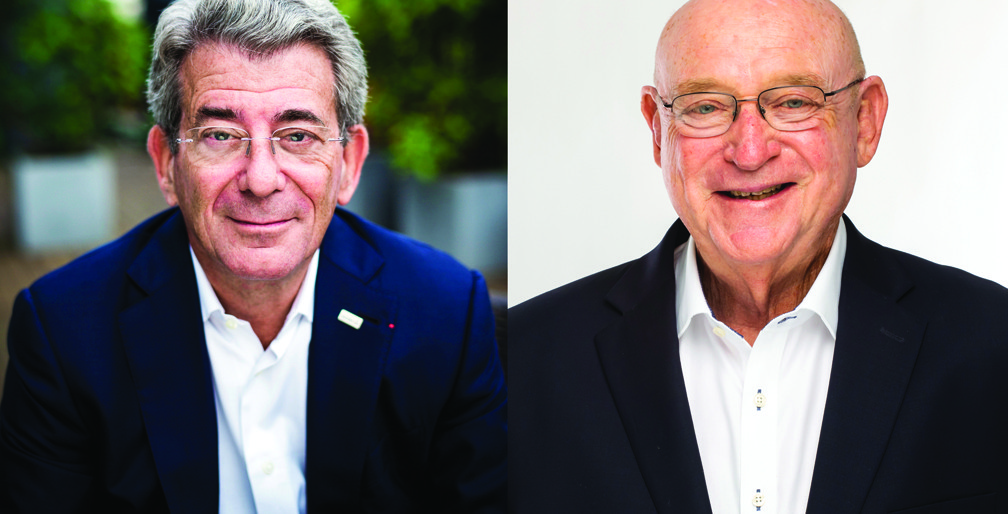

“Beyond the obvious money and time it can save via automation and rapid data processing, AI’s real strength lies in its keen ability to detect patterns and reveal new connections that make it possible to predict behavior,” says Oren Etzioni, CEO of the Allen Institute for AI.

As Etzioni notes, these patterns can help tomorrow’s tech-savvy breed of lenders reduce risk, outperform the competition and translate a shockingly wide range of insights into actionable business intelligence.

“Artificial intelligence, and especially deep learning technology, are poised to transform virtually every sector of the economy, and that will be especially true of the financial industry,” says Martin Ford, author of Rule of the Robots: How Artificial Intelligence Will Transform Everything. “AI will increasingly be utilized in the finance industry in areas like processing loan applications, and it will do this with improved accuracy and speed together with lower overhead costs.”

Even more importantly from the C-suite perspective: scalability. Such technology advancements already point to how companies in every field can use AI and machine learning to get smarter at scale. They suggest that tools can be leveraged to rethink traditional processes and procedures, including plotting business strategy and tackling risk management.

As noted in Harvard Business Review, AI even offers an alternative to traditional underwriting models that can make the consumer lending process fairer, less biased and more accurate. By utilizing AI-based modeling to provide more insightful predictions, firms such as U.S.-based Upstart and U.K. competitor Fintern effectively aim to make an end run around traditional credit scoring frameworks by creating their own applicant rating scorecard based on alternative variables.

Encouraged by these ventures’ expanding popularity, a growing range of artificially intelligent lending platforms such as Tavant’s Velox, Experian’s Ascend Intelligence Services and Zest AI—available as software tools that traditional lenders can implement as new solutions—are also now vying to disrupt the market.

With such options already enjoying a booming business, especially in global regions where more flexible consumer lending experiences are needed, some providers, such as India’s EarlySalary—a mobile app lender with 10 million downloads—currently leverage texting, browsing and social media history as relevant data points. Where you went to school, the city you grew up in and the types of individuals you keep company with are all increasingly becoming fair game for businesses to consider.

“For better or worse, AI now makes a plethora of data points that were previously not accessible or feasible for human evaluators newly available for risk analyses,” Etzioni says. “This can help a lender paint a more complete picture of an individual, but it can also inadvertently reinforce some of the unfair and unjust industry elements we already know are highly problematic, such as racial and social biases.”

Still, compared to traditional banking models, Upstart claims that it can boost loan approval rates by 173% without increasing loss rates—while empowering far more borrowers to avoid defaulting on these sums. Apart from providing more borrowers with access to credit and letting them access money for less, though, solutions such as Upstart’s enjoy another fundamental advantage over those of rivals. Specifically, it’s that they’ve noted that consumer lending (like many other business challenges) is mostly a big data problem at its core—so the field is ideally suited for disruption through artificial intelligence and machine learning.

Tellingly, investors are watching with great interest too. Since going public in December 2020, Upstart has sextupled in value, reaching a peak market map upward of $12 billion. Some industry observers remain skeptical nonetheless, with the European Union recently proposing a rule that would impose data-quality, testing and oversight requirements on AI providers.

Wherever you stand on the idea of machines making more lending- and underwriting-related decisions, though, it’s difficult to argue with the progress that AI-based lenders have been making. For example: Upstart recently announced agreements with Apple Bank and First Financial to power lending transactions, while Zest AI revealed a partnership with the Credit Union National Association to help streamline loan underwriting on a national basis. This means that in coming months, one’s ability to secure loan funding may be less a function of traditional credit history and more one of routine interactions and everyday money-management habits.

“Going forward, the importance of AI to organizations across the economy will only grow,” says Ford. “Those organizations that fail to adopt the technology and leverage it to the fullest extent possible are certain to fall behind and eventually become irrelevant. In contrast, those organizations that act now and begin to develop an AI strategy have an opportunity to enjoy a significant first-mover advantage.”

This article appeared in the Fall 2021 issue of Insigniam Quarterly. To begin receiving IQ, go here.