NPS: Tracking Customer Loyalty

Are your customers loyal?

It is one of those questions that strikes terror in the heart of the C-suite, not to mention marketing and sales teams—and it should. Customer loyalty cuts to the very core of an enterprise’s well-being. It not only dictates current revenues, it is a harbinger of future growth. So companies must have a keen understanding of where customer fidelity falls.

For more than a decade, many organizations around the world have relied on the Net Promoter Score (NPS) to gauge loyalty and satisfaction.1 The premise for the score is simple. A company asks its customers a single question: On a scale of 0 to 10, how likely are you to recommend our company or product or service to a friend or colleague? Customers who choose 6 or lower are considered detractors. Customers who select 9 or 10 are promoters. Those selecting 7 or 8 are considered passives or neutral. By subtracting the percentage of detractors from the percentage of promoters, the NPS is determined.

For more than a decade, many organizations around the world have relied on the Net Promoter Score (NPS) to gauge loyalty and satisfaction.1 The premise for the score is simple. A company asks its customers a single question: On a scale of 0 to 10, how likely are you to recommend our company or product or service to a friend or colleague? Customers who choose 6 or lower are considered detractors. Customers who select 9 or 10 are promoters. Those selecting 7 or 8 are considered passives or neutral. By subtracting the percentage of detractors from the percentage of promoters, the NPS is determined.

The remarkable part of the system is the sharp focus on those who are highly likely to recommend a company, product or service to another person.

“True loyalty clearly affects profitability,” argued NPS developer Fred Reichheld in a 2003 Harvard Business Review article. “Customers who are truly loyal tend to buy more over time, as their incomes grow or they devote a larger share of their wallets to a company they feel good about.”

Mr. Reichheld, a business strategist and author, compared a wide variety of questions to arrive at that one key question as a predictor of growth. He found that, on average, an industry’s NPS leader outgrew its competitors by a factor greater than two times.

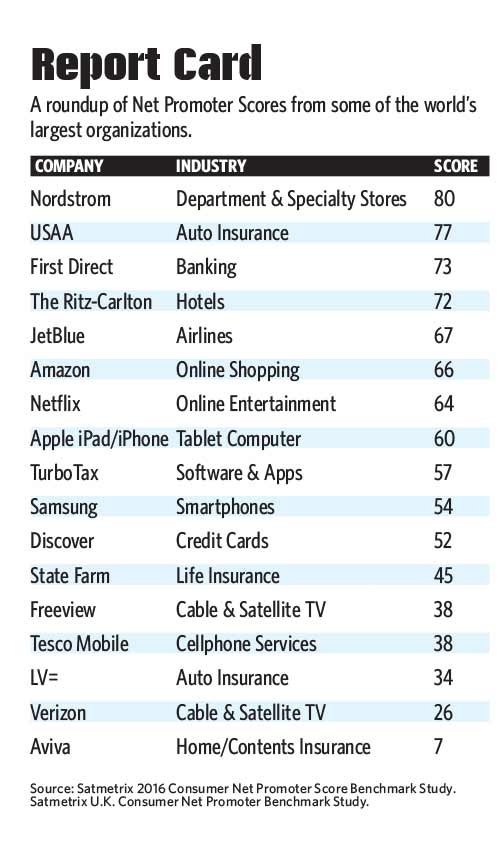

Since that article was published, NPS has become a business benchmark and, for some corporations, a key performance indicator. High-profile players such as First Direct, USAA, Netflix and JetBlue tout their status as NPS leaders to demonstrate their commitment to customer service excellence.

Part of the Business

The attraction to NPS is based on its ability to tie loyalty to bottom-line results, says Nathan Owen Rosenberg Sr., a founding partner of Insigniam. “You are not just asking customers if they are satisfied. At Insigniam, we are not merely interested in satisfying clients; we are committed to our clients realizing measured value from our consulting. NPS is at the core of our Client Value System.”

Mr. Rosenberg discovered Mr. Reichheld’s article a few years ago when he was looking for ideas on how to grow Insigniam’s business. “I was blown away by the data,” he says.

He shared the story and the Harvard Business Review article with his partners, and later that year, Insigniam implemented NPS as part of a broader strategy to expand the business through excellent customer service. Now, at the end of every client engagement, Insigniam consultants ask clients to rate their likelihood to recommend the firm and to quantify how much value the consultancy provided. Any time consultants score less than an 8, Mr. Rosenberg meets with them to talk through where they could do better. And when they score 10s, the whole firm celebrates the success.

“There is nothing better than giving executives a way to listen to customers and measure the impact of projects.”

“It has become like a heart monitor for us,” he says. “The consultants include it in their annual commitments and know it is important to keep an eye on that score, and it has been enough to change their behavior over time.”

In 2014, Insigniam’s NPS for the year was a respectable 50. But in the two years since implementing the program, the firm’s score has risen to 78, making the consultancy competitive with some of the best-ranked companies in the world.

Mr. Rosenberg makes sure stakeholders are aware of that elite status. He reports on NPS scores to the firm’s managers and executive committee, and in most partner meetings. “We look at the NPS as often as we look at our financials,” Share on X he says. “It is part of how we do business now.”

Finding the Good in the Bad

For many organizations, one of the key selling points of the NPS is its ability to sound the alarm for problems that may otherwise go undetected. Such was the case for nib Health Funds, a billion-dollar health insurance company in Australia.

In 2009, the organization launched a pilot program to test the value of tracking NPS among its customers who visited a nib dental center. Within weeks, the customer experience team discovered one of the centers was getting a higher level of detractors than others. When the team followed up with those detractors, comments showed a lot of complaints about noise and disruption at that center, says Adam Novak, nib’s head of customer experience. So Mr. Novak scheduled a site visit and found the walls of the center were so thin that clients could hear everything going on in adjacent patient rooms.

In response, the company moved the entire operation into a better-built facility.

That single pilot program drove home the value of tracking customer loyalty, Mr. Novak says, and the company has since rolled out NPS tracking to every department across the company. “It gives us immediate and powerful feedback that adds real value.”

NPS is now engrained in the culture and decision-making at nib. “It is part of the language we use to talk about customers and how the things we do will affect them,” Mr. Novak says.

The Upstart’s Advantage

The ability to track customer engagement can be a major boon for challenger brands as they enter new markets. Take Etisalat. In 2008, the multibillion-dollar telecom company headquartered in the United Arab Emirates opened a subsidiary in Nigeria, a market where three major operators were already in place.

“Even though we were a fast-growing company in a fast-growing market, it had been tough to establish a competitive position as the fourth entrant,” says Etisalat Nigeria CEO Matthew Willsher.

From the start, Etisalat differentiated itself by focusing on delivering an excellent experience—on every product and touch point, including face-to-face communications, apps and advertising—to its young, price-sensitive customer base. To ensure it was making the best choices, the marketing department started tracking NPS, along with hosting forums where managers and executives could respond directly to questions from customers.

“We see customer trends through these measures,” Mr. Willsher says. The qualitative outreach efforts help him and his team watch customer experiences, while the NPS scores quantify that experience and how it changes over time. That is especially appealing to the C-suite, which wants the balance of stories and numbers, he says. “There is nothing better than giving executives a way to listen to customers and measure the impact of projects.”

For example, the NPS for customer service increased significantly when Etisalat rolled out the latest iteration of its interactive voice software that lets customers get more answers through an automated call-in system. “There was a lot of resistance to the project be cause there is a perception that people want to talk to a live person,” Mr. Willsher says. However, requiring all calls to be handled by live people can lead to long wait times, a high rate of dropped calls and low satisfaction with the customer service experience.

cause there is a perception that people want to talk to a live person,” Mr. Willsher says. However, requiring all calls to be handled by live people can lead to long wait times, a high rate of dropped calls and low satisfaction with the customer service experience.

Within three months of implementing the new automated system, the NPS increased dramatically in almost every market. In the one community where it did not, Mr. Willsher’s team discovered the system did not support the local language, so the problem was resolved by adding a new language option. “NPS is a great way to find out if your projects are on track and to recognize where you may not have all the answers,” he says.

This relentless focus on measuring customer engagement has helped the company move ahead of two of its three biggest competitors.

Putting NPS in Context

The benefit of NPS is not inherent. Organizations cannot simply implement it and expect all of their problems to suddenly reveal themselves. If you do not put the score in the context of what you are trying to accomplish, it can get in the way, Mr. Novak says.

He notes that in the beginning, nib tied NPS scores to call center representative bonuses, which immediately caused scores to plummet. It turned out representatives were spending so much time on each call trying to make it an excellent service experience that queue times shot up, frustrating all of the other customers. “It is a learning process,” Mr. Novak says. To get the most value, companies need to know what they are striving for and how the NPS plays into their broader assessments of customer service.

Organizations also need to train employees on what the NPS is and why they must factor it into their decision-making processes. “Our firm was wedded to a 12-question client satisfaction survey,” Mr. Rosenberg says. “It took real education and some in-depth conversations with everyone in the firm to let go of that form and to make sure we were asking that one question of our clients at the end of every significant client intervention. You have to overcome any inertia or myopia when it comes to NPS.” Mr. Rosenberg advises executives to build a strong business case for using the measurement tool and to report results back to managers, business unit leaders, executives and other stakeholders. “It has to become a part of how you do business.”

In the beginning, Mr. Rosenberg and Insigniam’s design and innovation team spent hours evangelizing about NPS, and today he continues to remind people of its value to the business. In fact, the firm’s bonus system is tied to achieving a high overall NPS. “People will not just embrace NPS; you have to get them excited about it,” he says. But it is worth the effort. “Money follows value. The client or the customer is the arbiter of value. Share on X When people recognize the value that they generate or catalyze, it leads to better business results.”

1Net Promoter Score, Net Promoter and NPS are trademarks of Satmetrix Systems Inc., Bain and Company Inc. and Fred Reichheld.